Will You Be an Ostrich or an Eagle in 2024?

7 Resolutions for Community Bankers

Having observed animals in their natural habitats, I’m fascinated by their survival strategies in hostile environments. I hope my banking friends will benefit from what proceeds from my metaphoric title.

In South Africa, I discovered that ostriches are herding creatures; grass and bug grazers who hide or run from danger. During a face-to-face encounter, I observed their disorderly pecking movements, noting the substantial energy they expend through the dynamic movements of their heads and necks while remaining stationary.

In Alaska, I observed eagles that showcased strategic territory selection based on food availability and nesting opportunities. When hunting, the Eagle’s flight is direct, swift, quiet, and seemingly effortless. Eagles thrive close to home in often frigid temperatures. They also migrate hundreds of miles from their home nests to take advantage of salmon runs. Eagles go where the opportunities lie, while ostriches must suffice from bugs stirred up by zebras and other large herding animals.

Over my 40-year career working with community banks, I’ve observed the contrasting approaches of those soaring and thriving like eagles, and those defending and retreating like ostriches. In 1985, there were 14,434 community banks, but by Q323, this number dwindled to 4,614 – a 68% decline (per FDIC Call Reports). I anticipate that accelerated marketplace and technology changes will drive faster consolidation, resulting in about 2,500 community banks by 2030.

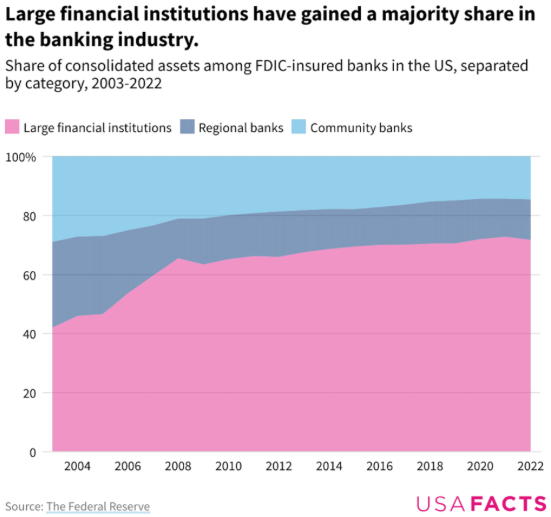

Now, consolidation does not alarm most bankers and there are upsides of course. But the trends in market share should raise a red flag for all community bankers. Beyond the massive growth of fintech and digital-only banks, market share has been shifting to the biggest banks for decades. The data indicates that over the past 20 years, community banks (<$10 B in assets) and regional banks ($10-100 B in assets) have been losing share to large financial institutions ($100B +). There are 30 banks with more than $100 billion in assets, so less than 1% of the banks are growing market share.

Market share is crucial because it drives efficiency, growth, and profitability, serving as a key indicator of an organization’s relevance and competitiveness. It is harder for community banks to gain market share due to competitive disadvantages including a higher, relative cost burden for security, compliance, and regulatory requirements. They also have fewer product and fee-based revenue streams, lower brand awareness, and a slower pace of technology/innovation adoption that’s restricted by lower operating margins.

Despite these hurdles, I believe community banks can thrive. Throughout 2024, I will make that argument by sharing information, strategies, and insights, organized around seven key resolutions I recommend for community bank growth and success:

1. Resolve to be Visionary and Bold

Leaders can either succumb to the pace of change or leverage it strategically for growth. Think longer term and commit to a big vision. Develop a 10-year plan that moves the culture and organization forward through 1, 3, and 5-year plans that reward the right behaviors and allocate resources to the most important strategic initiatives. Be determined to focus and win market share in your most important geographic, commercial, and consumer markets by leveraging the competitive strengths of being a community bank (i.e., relationships, local knowledge and decision-making, commitment to investing in the community).

2. Resolve to be Relevant

Once you’ve decided who your priority customers are, tailor your products, delivery, and services to meet their needs. In the current macro environment, targeting Gen Y and Gen Z is crucial. Align your brand, messaging, access, and service delivery to establish meaningful, long-term relationships built on trust, ease of use, and value. Be relevant and shift from transactional thinking to relationship-focused strategies.

3. Resolve to Leverage Data

First, use data analysis about your current and most profitable customers, and your ideal market segments, to inform the vision and strategic plan. Then, commit to leveraging data daily as your way of doing business. Build KPIs at the organizational, department, and employee level and constantly evolve those KPIs as you invest strategically in technology. Create the right reporting and feedback loops and provide customer knowledge and visibility to all your employees.

4. Resolve to be Easy

To effectively compete, your training, customer support, and online experience must be elevated to deliver tech-enabled, easy access to account information and to meeting the transactional needs of every customer type. Implement virtual assistant customer service technology while also ensuring seamless access for customers to connect with human beings for quick and effective high-touch assistance whenever needed.

5. Resolve to be Personal

In a world of hyper-personalization, tailor your marketing and communications to customers based on their preferences and needs. Utilize evolving tools as you build your data infrastructure. Customize account on-boarding and messaging flows so they are relevant to your various customer types.

6. Resolve to be Worthy

You want to win a customer for life, so you need to be relevant and supportive of that customer at every stage of the personal or business lifecycle. Use competitive analysis, market research, and feedback loops to gauge your effectiveness in meeting customer needs and to identify areas for improvement. Utilize these insights to empower your team to implement new products and solutions and faster ways to resolve issues.

7. Resolve to be Impactful

Customer success and happiness is your first impact goal. Today’s customers also want to see your bank contribute more strategically to community impact. Many banks make dozens of smaller contributions to non-profits and community associations. I recommend you also think about committing to and leading a cause-based program that can impact your communities in a more scalable way. That level of leadership and commitment will increase your impact over time – and will solidify your brand value as well.

Recognize that you don’t have to navigate this journey alone. Find the right partners who align with your vision. Demand more of your core service providers. Engage and inspire both your employees and customers as you communicate and implement your vision, plans, and community impact initiatives. Doing so will enable you to capture market share and to grow profitably and more confidently into the future.